Stamp Duty Exemption Malaysia 2020

Are you going to buy a house for the first time in the year 2020? Then this Exemption For Stamp Duty can be handy to you.

When buying a house, the property stamp duty can stand a considerable amount compared to other fees involved.

So, let’s get to know the property stamp duty and the exemption for stamp duty.

What is Property Stamp Duty in Malaysia?

Property Stamp Duty is a tax charged by the Malaysian government when you’re buying a property in Malaysia. Every individual purchasing a property, either is Malaysian, or a Foreigner is required to pay a Property Stamp Duty (Malaysia).

And sadly, for Malaysians or foreigners, they are paying the same amount of Property Stamp Duty in Malaysia.

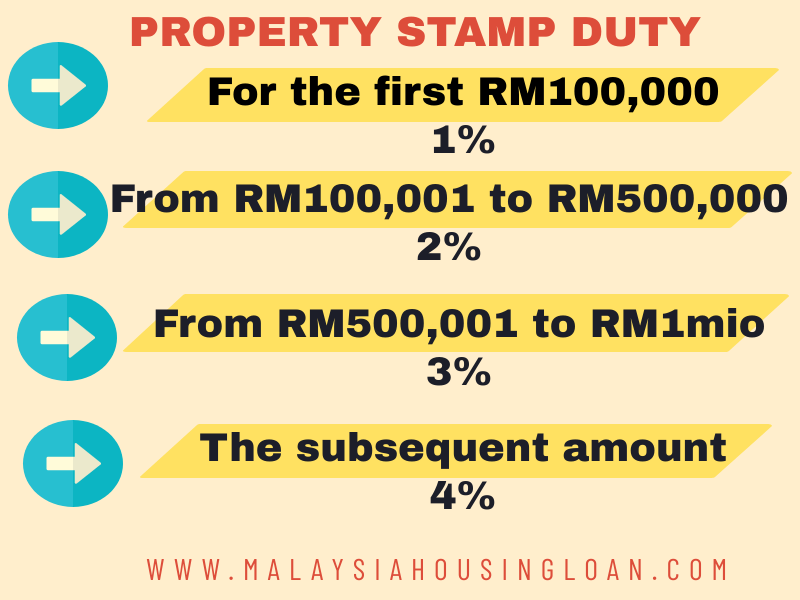

Here is The Property Stamp Duty in Malaysia scale.

For the first RM100,000, 1%

From RM100,001 to RM500,000, 2%

From RM500,001 to RM1mio, 3%

The subsequent amount is 4%

You do not need a Property Stamp Duty Calculator to calculate the stamp duty. It’s quite easy to calculate.

How Stamp Duty is Calculated?

Example,

*Property Market Value is RM500,000

For the first RM100,000, 1% x RM100,000 = RM1000

From RM100,001 to RM500,000, 2% x RM400,000 = RM8000

Total Stamp Duty is RM9000

Side Note :

I wrote *Property Market Value because the property stamp duty will be based on the Property Market Value or Purchase Price, whichever is higher.

What is Stamp Duty Exemption 2019-2020?

Stamp Duty Exemption 2019-2020 is an exemption or rebate given by the Malaysia Government to a first-time house buyer.

Stamp Duty Exemption 2020 For First Time Buyer

The Stamp duty exemption 2020 is given to first home buyers that purchasing a property worth RM500,000 and below.

The stamp duty exemption is for the first RM300,000 property value stamp duty on the instrument of transfer. That will be up to a maximum stamp duty exemption of RM5000.

Not only that, the stamp duty exemption is also extended to the stamp duty on loan agreement too.

For stamp duty on the instrument of the loan agreement, the stamp duty exemption is also for the first RM300,000 loan amount. That will come to a maximum stamp duty exemption of RM1500.

Therefore in total, the stamp duty exemption is up to RM6500 to grab.

STAMP DUTY MALAYSIA CALCULATION

Let’s do some stamp duty calculations to understand it better.

Example 1:

Ali is not a first-time house buyer.

Property Value: RM300,000

Loan Amount: RM270,000

Property Stamp Duty

RM100,000 x 1% = RM1000

RM200,000 x 2% = RM4000

Actual Stamp Duty: RM5000

Stamp Duty Exemption Amount: RM0.00 (Not first time home buyer)

Payable Stamp Duty: RM5000

Stamp Duty Loan Agreement

Actual Stamp Duty: RM270,000 x 0.50% = RM1350

Stamp Duty Exemption Amount: RM0.00 (Not first time home buyer)

Payable Stamp Duty: RM1350.00

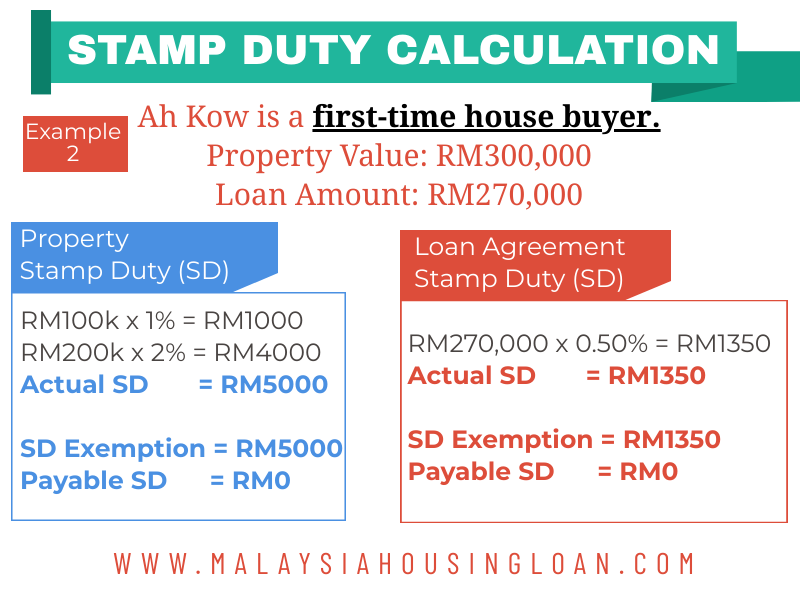

Example 2:

Ah Kow is a first-time house buyer.

Property Value: RM300,000

Loan Amount: RM270,000

Property Stamp Duty

RM100,000 x 1% = RM1000

RM200,000 x 2% = RM4000

Actual Stamp Duty: RM5000

Stamp Duty Exemption Amount: RM5000.00 (first time home buyer)

Payable Stamp Duty: RM0.00

Stamp Duty Loan Agreement

Actual Stamp Duty: RM270,000 x 0.50% = RM1350

Stamp Duty Exemption Amount: RM1350 (first time home buyer)

Payable Stamp Duty: RM0.00

Example 3:

Muthu is a first-time house buyer.

Property Value: RM500,000

Loan Amount: RM450,000

Property Stamp Duty

RM100,000 x 1% = RM1000

RM400,000 x 2% = RM8000

Actual Stamp Duty: RM9000

Stamp Duty Exemption Amount: RM5000.00 ( max stamp duty exemption amount for first time home buyer)

Payable Stamp Duty: RM9000-RM5000= RM4000.00

Stamp Duty Loan Agreement

Actual Stamp Duty: RM450,000 x 0.50% = RM2250

Stamp Duty Exemption Amount: RM1500( max stamp duty exemption amount for first time home buyer)

Payable Stamp Duty: RM750.00

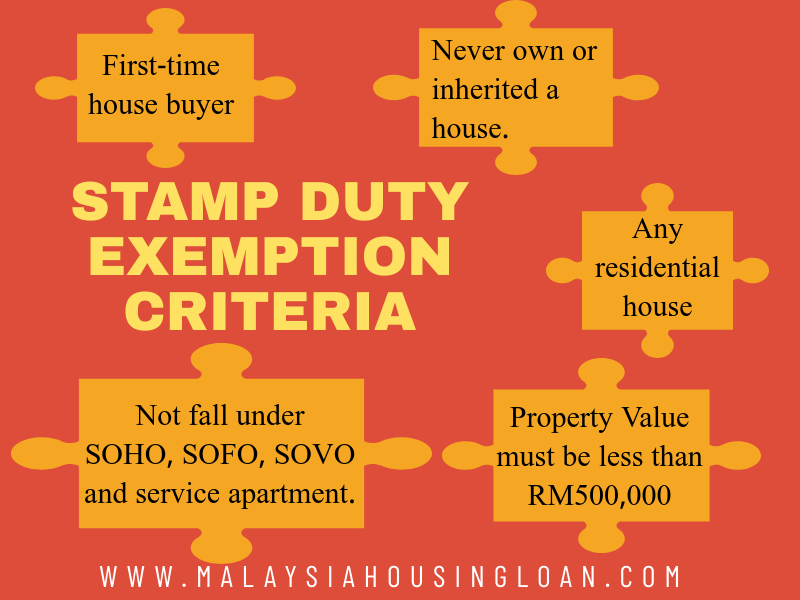

The summary criteria for getting Stamp Duty Exemption 2019-2020 are as follows.

- First-time house buyer.

- Never own or inherited a house.

- Any residential house.

- The house must not fall under a small office home office (SOHO), small office flexible office (SOFO), small office virtual office (SOVO) and service apartment.

- Property Value must be less than RM500,000

- the stamp duty exemption is for stamp duty on the first RM300,000 property value and loan amount.

Here are a few Stamp duty (remission) order for first home buyers. ( Valid until 31st December 2020)

You can pass down this stamp duty remission order to your lawyer, if he is unaware of the exemption for stamp duty.

Stamp Duty (Exemption) (No. 6) Order 2018 (P.U. (A) 377) – all stamp duty chargeable for transfer of property worth not more than RM300,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.01.2019 until 31.12.2020.

Stamp Duty (Exemption) (No. 4) Order 2018 (P.U. (A) 321) – all stamp duty chargeable on any loan agreement to finance the purchase of property worth not more than RM300,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.01.2019 until 31.12.2020.

Stamp Duty (Remission) Order 2019 (P.U. (A) 49) – a total of RM5,000 of stamp duty chargeable for transfer of property worth in between RM300,000 to RM500,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.07.2019 until 31.12.2020. This order, however, shall only be effective from 01.07.2019 onward.

Stamp Duty (Remission) Order 2018 (P.U. (A) 320) – all stamp duty chargeable on any loan agreement to finance the purchase of property worth in between RM300,000 to RM500,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.07.2019 and 31.12.2020. This order, however, shall be effective from 01.07.2019 onward.

You might also like to read this article, MEMORANDUM OF TRANSFER MALAYSIA.

We hope you enjoy this article, feel free to SHARE and LIKE or if you have any questions about this, you can reach us at 012-6946746. We love to help!

LIKE, SHARE & FOLLOW US!

#malaysiahousingloan

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746

Request A Free Quotation From Us Today

Quotation For

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

Leave A Comment