Memorandum of Transfer (MOT)

If you own a house, you have to start familiarizing yourself with the Memorandum of Transfer (MOT).

There will be a time in life that you’re going to get to know the Memorandum of Transfer (MOT), and I think a head-start about Memorandum of Transfer (MOT) is going to help you a lot.

What is Memorandum of Transfer & how does it work in Malaysia?

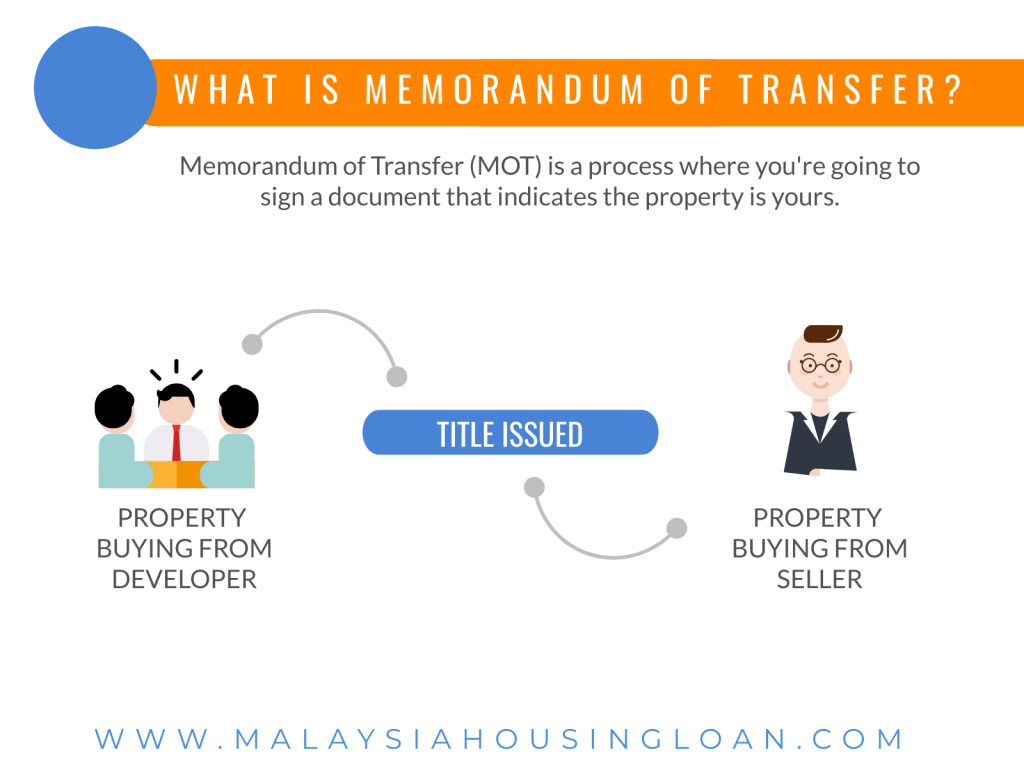

What is the Memorandum of Transfer ( MOT)?

Memorandum of Transfer (MOT) is a process where you’re going to sign a document that indicates the property is yours.

For example,

You bought a property from a developer during under-construction. After the property completed and individual title issued, you have to sign a Memorandum of Transfer document to transfer the property ownership from the developer to you.

Or in case of buying from a property agent or seller ( if the property title issued), you’ll sign a Memorandum of Transfer document and transfer ownership of the house from the seller to you.

Memorandum of Transfer in Malaysia

What is Property Transfer (Malaysia)?

Typically when an individual said they want to perform a Property Transfer, it means that the individual wants to transfer his/her property to another party.

Most of the time, the property transfer is involving from Parents to Child, between spouses or within the family members.

A Handy Guide To Legal Documents And Memorandum of Transfer (MOT)

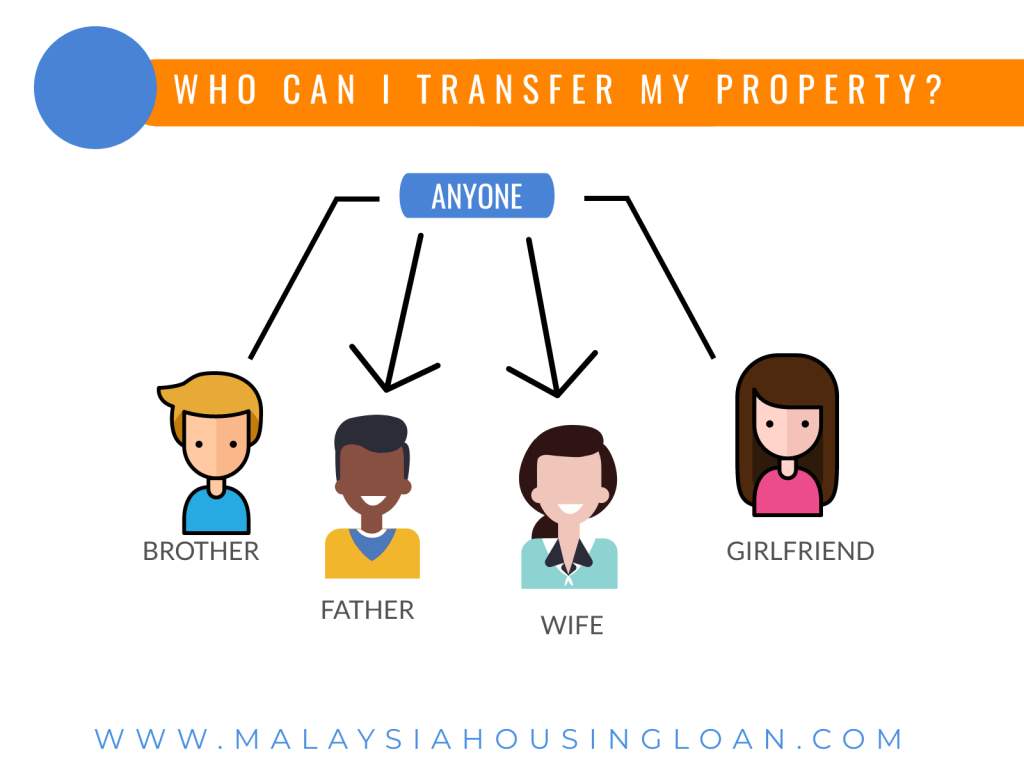

Who can I transfer my property?

If you own a house, you can perform property transfer to anyone you like. The law doesn’t restrict you from transferring the property to your family member only; you can transfer to your friend, boyfriend, girlfriend, or any stranger.

How do you transfer property ownership or transfer a house into someone else’s name?

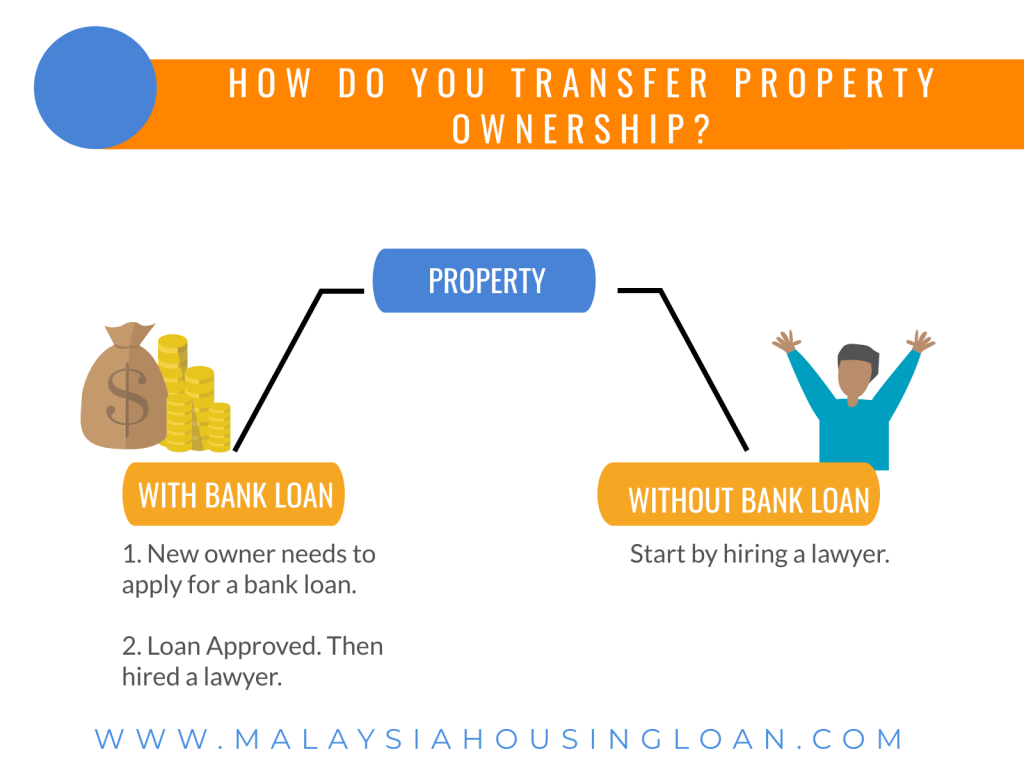

You have to identify whether the property still has a bank loan before decided to transfer the property. It will be easier if without a bank loan.

If there is a bank loan, your new owner needs to get a bank loan before the Property Transfer can be started.

The tricky part is a transfer outside the family member is not favorable for the bank.

Form 14A Memorandum of Transfer

You need an experienced lawyer to handle the Memorandum of Transfer. The lawyer will ask you to sign Form 14A Memorandum Of Transfer.

Form 14A will indicate who is the owner and who is the transferor, transferee, and how much shares you want to transfer. You can choose to transfer all, 50% of the property or any amount.

If you want to know the total cost of property transfer, you can click the link below to request a Memorandum Of Transfer quotation.

https://malaysiahousingloan.net/legal-fees-calculator/

Memorandum of Transfer ( MOT) For Strata Title and Individual title

Memorandum Of Transfer is only for Strata Title and Individual title property.

If you have a master title property, you can’t perform by way of Memorandum Of Transfer (MOT). Instead, you have to go with Deed of Gift process, which is a different document to sign.

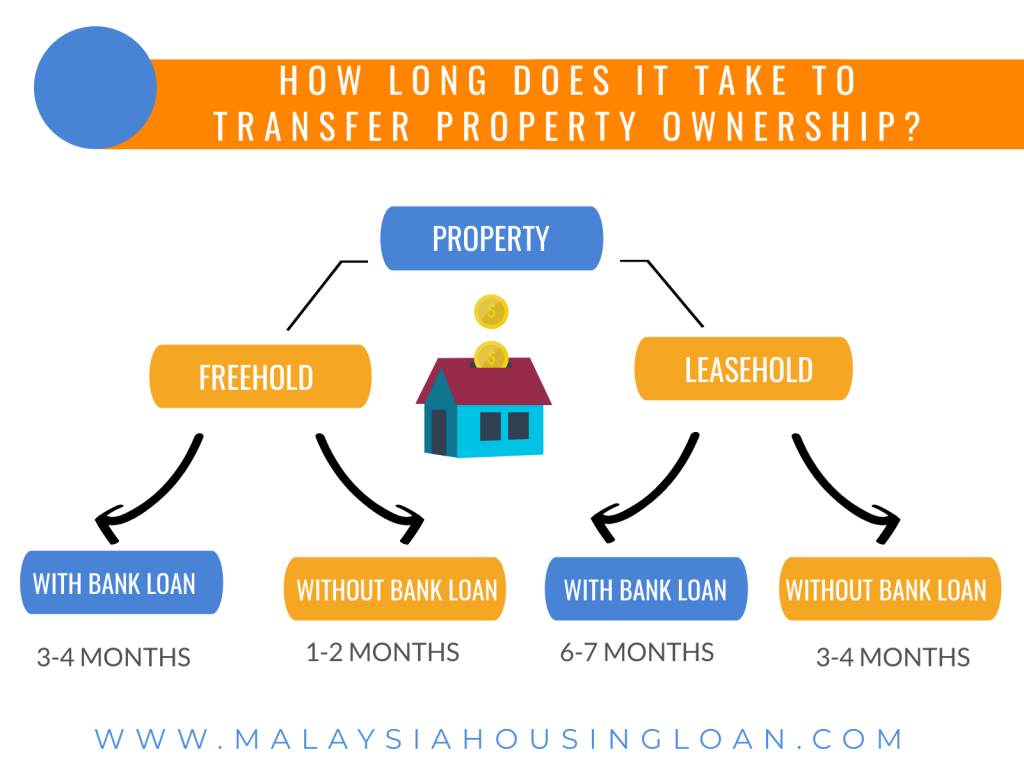

How long does it take to transfer property ownership?

It depends on your situation.

Property transfer for without a bank loan will be faster than with a bank loan.

A freehold property will be faster than a leasehold property because a leasehold property requires applying for consent.

In a straight forward case, a freehold case without a bank loan should take about one to one and a half months.

And, while a leasehold case without a bank loan should take about three to four months.

Memorandum of Transfer Fee

Memorandum of Transfer fee depends on the type of transaction you are required to do.

Here are a few transactions that involved the Memorandum of Transfer.

a. Property Title Issued

When you buy a master title property, and later on, the property title is issued.

And you are required to perform a property transfer from earlier owner or developer to your name.

Usually, we will call this the Perfection of Transfer ( POT ).

And if there is a bank loan, you’ll need to perform Perfection Of Charge ( POC) too.

b. Property Transfer To Other Party

You want to transfer your property to other parties like a family member or any individual.

Side note: If the property still with a bank loan, we will strongly advise you to consult us first. There is a way to do it, but with a wrong move, it will cost you more.

If you would like to get the cost of doing the above transaction, please click the link below and request a quotation.

https://malaysiahousingloan.net/legal-fees-calculator/

Property Transfer Stamp Duty

The cost of a memorandum of transfer or property transfer is consists of the professional legal fee, stamp duty, disbursement fees, and sale and service tax.

The Property Stamp Duty stands a considerable amount compare to other fees. So let’s look at the stamp duty fees.

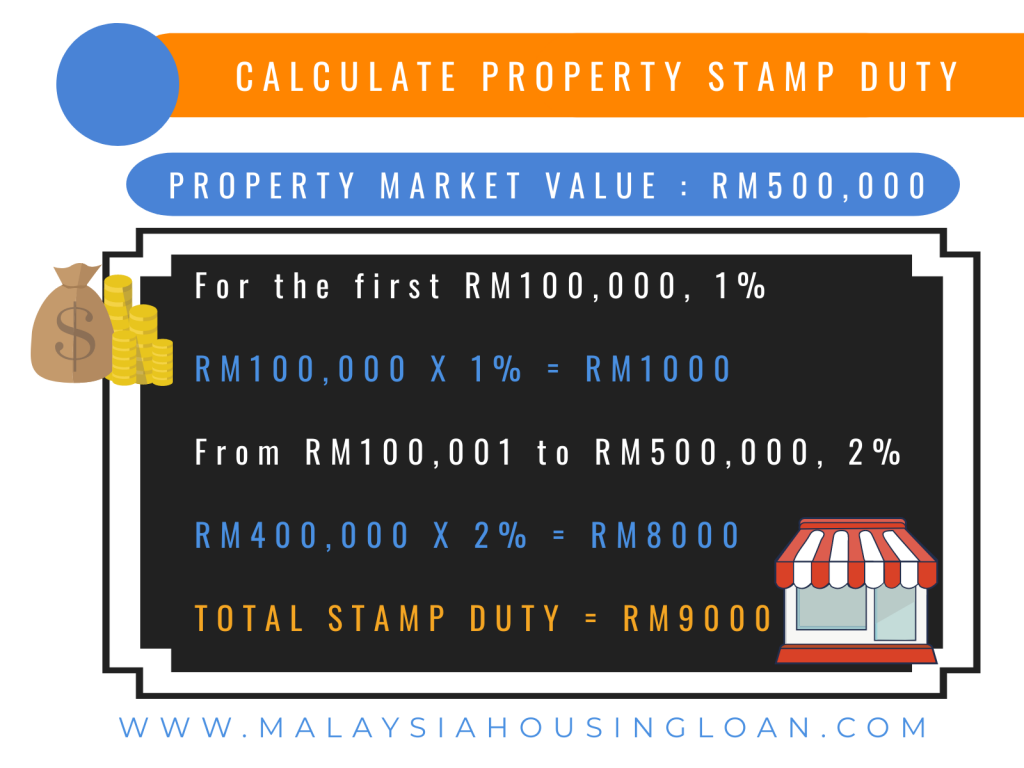

The Property Stamp Duty scale is as follows.

For the first RM100,000, 1%

From RM100,001 to RM500,000, 2%

From RM500,001 to RM1mio, 3%

The subsequent amount is 4%

You do not need a Memorandum of Transfer ( MOT) calculator to calculate the stamp duty. It’s quite easy to calculate.

For example,

*Property Market Value is RM500,000

For the first RM100,000, 1% x RM100,000 = RM1000

From RM100,001 to RM500,000, 2% x RM400,000 = RM8000

Total Stamp Duty is RM9000

Side Note :

I wrote *Property Market Value because the stamp duty will be based on the Property Market Value or Purchase Price, whichever is higher.

Unless you’re doing perfection of transfer (POT), POT will be based on the earlier Sale and Purchase Agreement Price.

Next is my favorite part.

For stamp duty Exemption Malaysia please refer to:

https://malaysiahousingloan.com/malaysia-stamp-duty-exemption/

Stamp Duty Exemption 2020 ( Malaysia )

If you’re buying a house or transferring a property, there is a stamp duty exemption (Malaysia) that you should know.

a. Stamp duty exemption 2020 for first home buyers. ( Valid until 31st December 2020)

Stamp Duty (Exemption) (No. 6) Order 2018 (P.U. (A) 377) – all stamp duty chargeable for transfer of property worth not more than RM300,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.01.2019 until 31.12.2020.

Stamp Duty (Exemption) (No. 4) Order 2018 (P.U. (A) 321) – all stamp duty chargeable on any loan agreement to finance the purchase of property worth not more than RM300,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.01.2019 until 31.12.2020.

Stamp Duty (Remission) Order 2019 (P.U. (A) 49) – a total of RM5,000 of stamp duty chargeable for transfer of property worth in between RM300,000 to RM500,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.07.2019 until 31.12.2020. This order, however, shall only be effective from 01.07.2019 onward.

Stamp Duty (Remission) Order 2018 (P.U. (A) 320) – all stamp duty chargeable on any loan agreement to finance the purchase of property worth in between RM300,000 to RM500,000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01.07.2019 and 31.12.2020. This order, however, shall be effective from 01.07.2019 onward.

b. Stamp duty Exemption for love and affection ( No expiry date )

Stamp Duty (Remission) (No. 7) Order 2002 (P.U. (A) 434): parents, child.

This is a ministerial order which provides for the remission of 50% of stamp duty chargeable on any instrument of transfer of immovable property between parents and child. This order had since been in effect from 01.01.2003.

Stamp Duty (Exemption) (No. 10) Order 2007 (P.U. (A) 420): spouses

This is another ministerial order which provides for full exemption of stamp duty chargeable on any instrument of transfer of immovable property between spouses. This order had since been in effect from 08.09.2007, superseded P.U. (A) 434 in terms of stamp duty chargeable on the instrument of transfer of property between spouses.

According to the above, the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows:

a. Husband to Wife : 100%

b. Wife to Husband : 100%

c. Mother and/or Father to Child : 50%

d. Child to Mother and/or Father : 50%

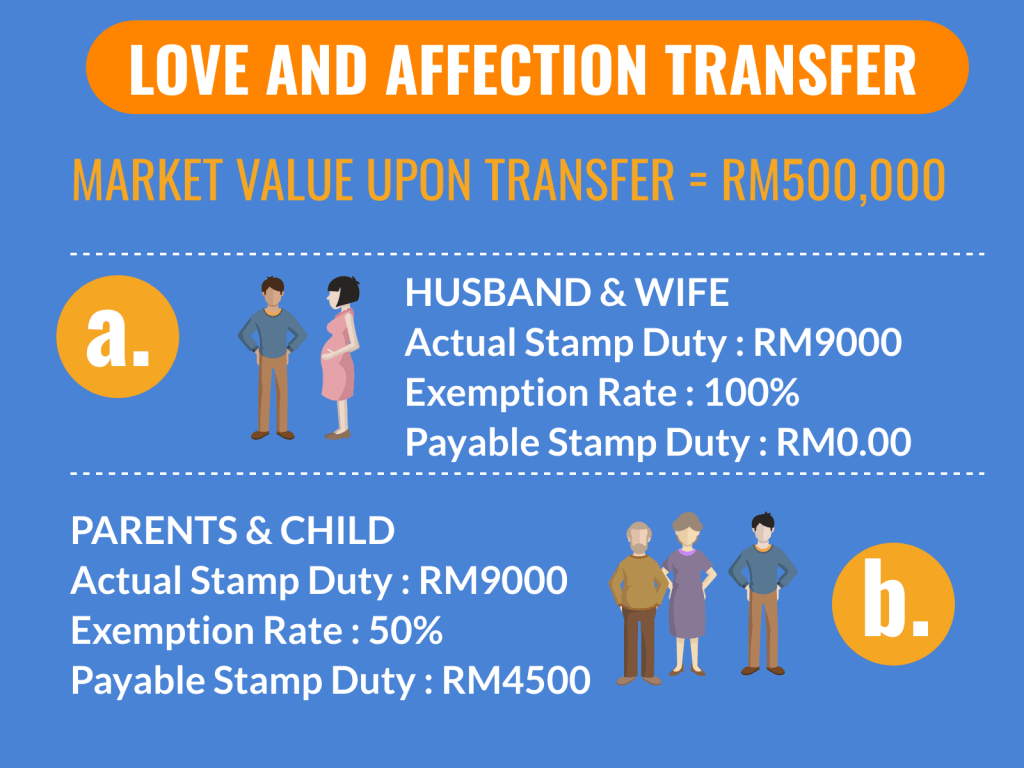

Here I have a few examples of stamp duty calculation for Property Transfer using Love and Affection.

For example, the Market Value upon Transfer is RM500,000.

A. Between Husband and Wife

Actual Stamp Duty : RM9000

Exemption Rate : 100%

Payable Stamp Duty : RM0.00

B. Between Parents and Child

Actual Stamp Duty : RM9000

Exemption Rate : 50%

Payable Stamp Duty : RM4500.00

C. Between Sibling

Actual Stamp Duty : RM9000

Exemption Rate : 0%

Payable Stamp Duty : RM9000

D. Parents Transfer 50% shares of Property to a child

Actual Stamp Duty : RM4500

Exemption Rate : 50%

Payable Stamp Duty : RM2250.00

c. Stamp duty exemption for Property Under National Home Ownership Campaign 2019 ( valid until 31st December 2019)

Stamp Duty (Exemption) (No. 2) Order 2019 (P.U. (A) 81) – all stamp duty chargeable on any loan agreement to finance the purchase of property worth in between RM300,000 to RM2,500,000 (after 10% discount by property developer) is exempted provided that it is the purchase of residential property under the HOC 2019 and the sale and purchase agreement is dated in between 01.01.2019 until 30.06.2019 (which has now been extended until 31.12.2019 via Stamp Duty (Exemption) (No. 2) Order 2019) (Amendment) Order 2019 (P.U. (A) 173) for purchase of property directly from a property developer. This exemption, however, shall only be applicable with the HOC 2019 Certification issued by REHDA, SHAREDA or SHEDA.

Stamp Duty (Exemption) (No. 3) Order 2019 (P.U. (A) 82) – a total of up to RM24,000 stamp duty chargeable on transfer of property worth in between RM300,000 to RM2,500,000 (after 10% discount by property developer) is exempted provided that it is the purchase of residential property under the HOC 2019 and the sale and purchase agreement is dated in between 01.01.2019 until 30.06.2019 (which has now been extended until 31.12.2019 via Stamp Duty (Exemption) (No. 2) Order 2019) (Amendment) Order 2019 (P.U. (A) 174) for purchase of property directly from a property developer. This exemption, however, shall only be applicable with the HOC 2019 Certification issued by REHDA, SHAREDA or SHEDA.

You might also like to read this article, Transfer of Property Between Family Members in Malaysia – Love and Affection Property Transfer and Transfer Property To Family Member.

We hope you enjoy this article, feel free to SHARE and LIKE or if you have any questions about this, you can reach us at 012-6946746. We love to help!

LIKE, SHARE & FOLLOW US!

#malaysiahousingloan

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746

Request A Free Quotation Now!

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

Leave A Comment