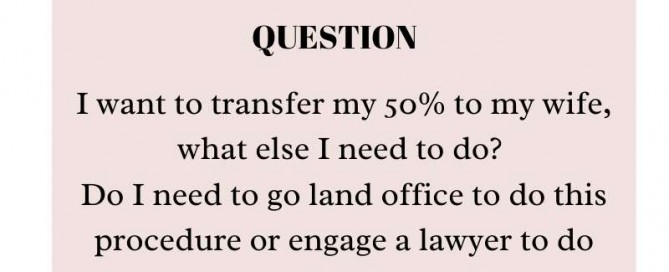

Stamp duty should be calculated from purchase price or market price?

Hi Melissa, I bought an apartment in year 1998 directly from the developer. Recently, I received a letter from liquidator requesting me to assign my own lawyer for POT. Stamp duty should be calculated from purchase price or market price? Some lawyer quote me from purchase price, some by market price! Answer : [...]