Property Transfer Love & Affection 2020

You’re a Father, and you have a son. You figure that it will come a time to transfer one of your property to your son. And you’re not sure how to do it.

Well. I guess this is the article for you.

First of all, let start by answering the following questions about property transfer from father to son.

#1: Is the Property Still Has A Bank Loan?

Yes.

If the answer Yes. It means the property still charged with a bank.

A bank will not allow you to transfer your property to your son without taking a new bank loan. The new bank loan shall be under the new owner’s name, in this case, your son. Your son has to take a bank loan, either by him or joint with you.

No.

If the answer No. It means you have fully settled the bank loan or you pay cash to buy the property. It doesn’t matter which, it is more straight forward this way.

You can right away appoint a lawyer to handle your property transfer from mother father to son.

# 2: Is the Property still under Strata/Individual title or Master Title?

Strata & Individual Title

If your property has a Strata & Individual Title, you could perform the property transfer by way of Memorandum of Transfer ( MOT ).

It also much straight forward if the property title is issued.

Master Title

For Master Title property, you will need a copy of the Sale and Purchase Agreement. Since the property doesn’t have Strata or Individual Title, therefore the lawyer will execute under the Deed of Gift.

But, bear in mind that the Deed of Gift with an existing bank loan is complicated because the existing bank loan is required to be fully settled before the transaction can be completed.

#3:Do Your Son Needs A Bank Loan For this Property?

Yes.

If your son requires a bank loan, then you can start applying for a bank loan during the property transfer process. But, it is essential to inform the bank that the transaction you are doing is a memorandum of transfer ( MOT) by way of love and affection.

If by any chance, you need a good recommendation of bankers. We could introduce a few to you. Just give us a call at +6012-6946746.

No.

If your son doesn’t need a bank loan, then he doesn’t need to do anything.

# 4: Survey For the Cost

With A New Bank Loan.

Now you have a slight idea on how to proceed for your property transfer from father to son. Next will be to figure out the cost.

There will be two costs involved in this transaction.

a. Property Transfer

The initial cost is in the preparation of Memorandum of Transfer or Deed Of Gift. This cost will include Professional Lawyer Fees, Property Stamp Duty, and Disbursement Fee. It is essential to understand that the cost will be calculated based on the property market value.

For example,

If the property market value is RM500,000. You will be paying lawyer fees and stamp duty based on the RM500,000 property value.

And RM500,000 property lawyer fees are RM5000, and property stamp duty will be RM9000.

b. New Bank Loan

If you require a bank loan, you will enter a Loan Agreement with the bank. The preparation of the documents and the completion of the transaction will be by a bank lawyer. So, as I last check, the bank lawyer doesn’t come FREE. You will require to pay the cost too.

The cost will include Professional Lawyer Fees, Property Stamp Duty, and Disbursement Fee. In estimation, the price is typically about 2-3% of your loan amount. However, most banks can finance these fees.

Without A Bank Loan.

If without a bank loan, the only fee you need to worry about is the cost preparation of Memorandum of Transfer or Deed Of Gift. You can refer to the above.

This cost will include Professional Lawyer Fees, Property Stamp Duty, and Disbursement Fee. It is essential to understand that the price will be calculated based on the property market value.

In case if you need a quotation for this. Head over to the following link, and you will get one.

https://malaysiahousingloan.com/legal-fees-calculator/

#5: Appoint A Lawyer

Next, you need to appoint a lawyer to handle this. But before selecting the lawyer, you might need to know the cost of the property transfer. You can get a quotation from the lawyer before appointing them. I’d suggest not to get on board before knowing your price.

Alternatively, you can request for property transfer quotation from us here, or if you need a lawyer to do the work for you, we can help too.

https://malaysiahousingloan.com/legal-fees-calculator/

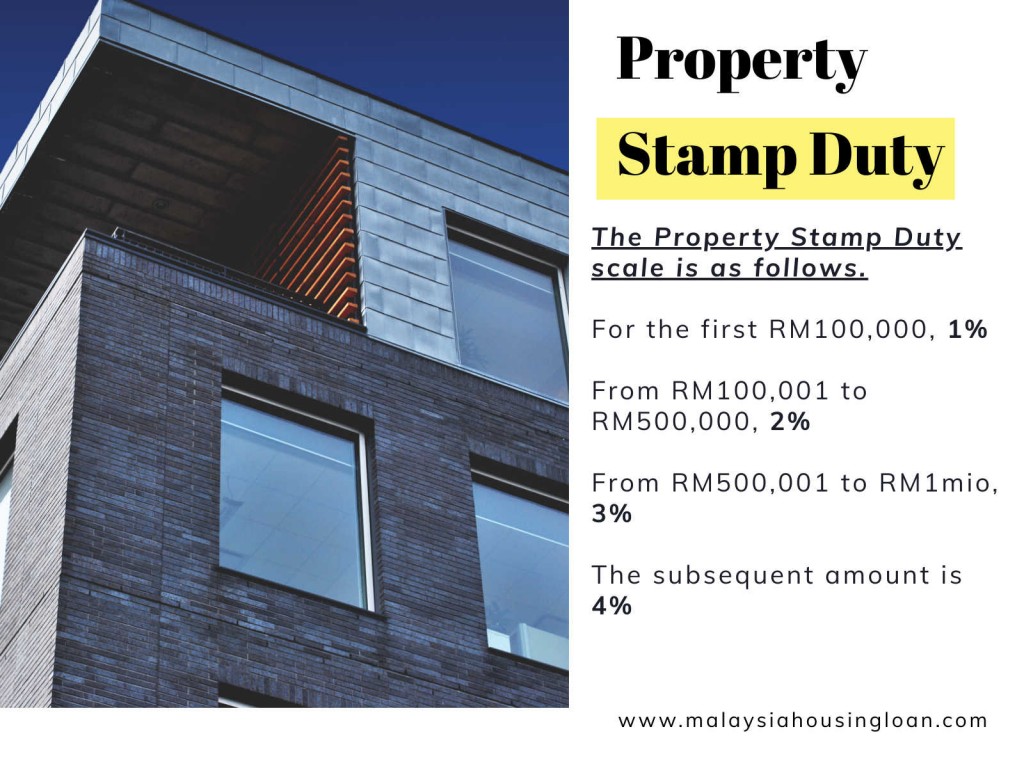

In case if you’re wondering the rate of Property Stamp Duty.

The Property Stamp Duty scale is as follows.

For the first RM100,000, 1%

From RM100,001 to RM500,000, 2%

From RM500,001 to RM1mio, 3%

The subsequent amount is 4%

What did the law say about Transfer Property From Father to Son?

Stamp duty Exemption for love and affection ( No expiry date )

Stamp Duty (Remission) (No. 7) Order 2002 (P.U. (A) 434): parents, child.

This is a ministerial order which provides for the remission of 50% of stamp duty chargeable on any instrument of transfer of immovable property between parents and child. This order had since been in effect from 01.01.2003.

According to the above, the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows:

a. Mother and/or Father to Child : 50%

b. Child to Mother and/or Father : 50%

Here I have a few examples of stamp duty calculation for Property Transfer using Love and Affection.

For example, the Market Value upon Transfer is RM500,000.

A. Between Parents and Child

Actual Stamp Duty : RM9000

Exemption Rate : 50%

Payable Stamp Duty : RM4500.00

B. Parents Transfer 50% shares of Property to a child

Actual Stamp Duty : RM4500

Exemption Rate : 50%

Payable Stamp Duty : RM2250.00

You might also like to read this article, Transfer of Property Between Family Members in Malaysia – Love and Affection Property Transfer and Transfer Property To Family Member.

We hope you enjoy this article, feel free to SHARE and LIKE or if you have any questions about this, you can reach us at 012-6946746. We love to help!

LIKE, SHARE & FOLLOW US!

#malaysiahousingloan

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746

Request A Free Quotation From Us Today

Quotation For

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

Leave A Comment