PAY LATE, BANK INCREASE INTEREST RATE

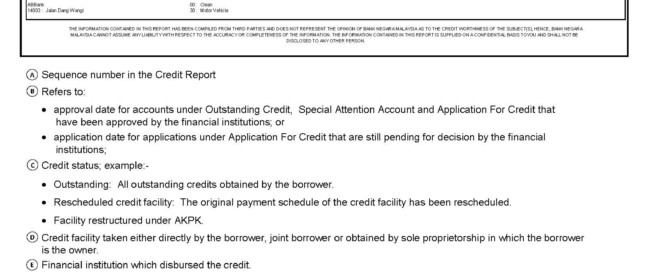

Just a community reminder to all the house owner out there to be more diligent when handling existing home loan account. Some banks are imposing a penalty in home loan interest rates to a borrower that make a late payment to their home loan account for consecutive two months. Let’s check out the sample of [...]