Bank Negara Malaysia (BNM) have increased the overnight policy rate (OPR) at 3.25% from 3.0% in the monetary policy committee (MPC).

This OPR hike may translate to an increase in the pricing of loans for consumers.

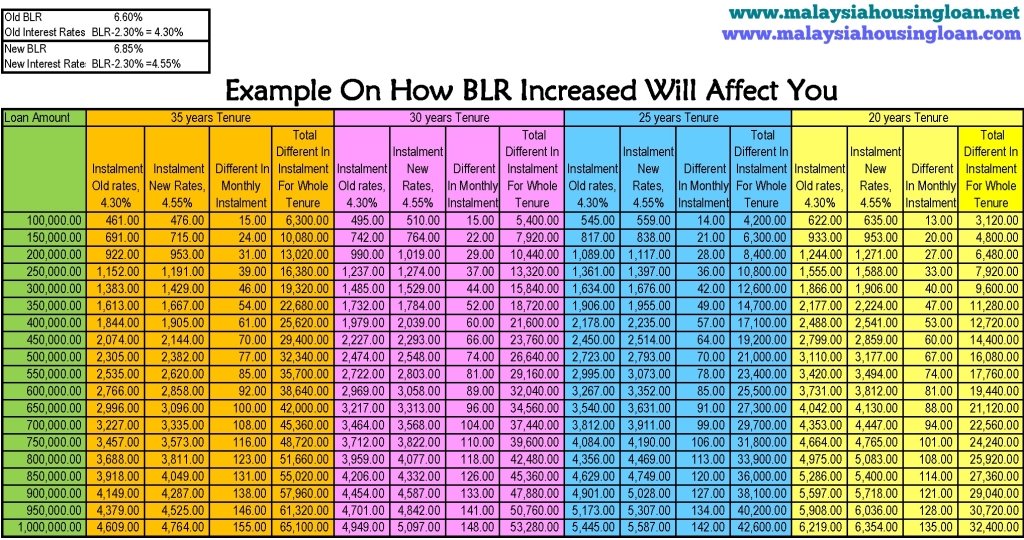

Banks had started to announce their increase in Base Lending Rate (BLR). Public Bank are one of the banks that had confirm their new BLR is 6.85% effective 10th July 2014.

Most analysts are expecting a high probability of a rate hike in 2014, which it is true. While less a handful opined that it could go up to 50bps by end of 2014. If there is a 50bps hike, one can generally expect that BLR will increase to 7.10%.

The OPR is an overnight interest rate set by BNM. It is interest rate at which a bank lends to another bank.The OPR, in turn, has an effect on employment, economic growth and inflation. It is an indicator of the health of a country’s overall economy and banking system.

If you’re a borrower, when the interest rate goes up, you need to pay more in terms of instalment. Alternatively, your term of loan (loan tenure) increases if you don’t want to change your instalment payment.

But, if you are a depositor, for example you have fixed deposit or saving account with the banks, this mean your fixed deposit and saving account dividend will be increase too.

OPR, BLR & deposit interest rate are co-related. Once OPR increase, BLR and deposit interest rates will be follow suit too.

Here is the example of how it would affect you:

Based on the example above, the 25bps hike will not be severely affect. However, over the loan period, it comes up to a substantial amount.

Fixed rate loans will work in your favour if interest rates go higher. To know more about Fixed rates loan offer, please go to contact us or click here.

Leave A Comment