Hey guys, my name is Melissa Lee, and I’m from MalaysiaHousingLoan.com.

Today, we’re going to talk about How To Check The Market Value Of Property? And For FREE.

Before we dive into the topic, I would like to talk a little about property market value.

Property Market Value is quite essential when you want to buy or sell a house, depending on whether you are a seller or purchaser.

As a seller, you want to sell as high as possible, maybe more than the market value but not too high because you don’t want your purchaser has a hard time in getting a home loan.

As a purchaser, you want to buy a property that within the property market value or it would be a sweet deal if the property price is lower than the market value.

WHY IS THE MARKET VALUE IMPORTANT?

The bank will be engaged with a valuation firm to estimate the property market value before the approval. Or to be exact during submission.

For example,

You have booked a house, and the property purchase price is RM500,000.

And the next step is getting a bank loan from the bank.

So, you submit all your documents to the bank for submission and approval.

The bank officer will process your application.

They will make sure everything in order.

One of the things they will check is the property market value.

They will give the bank’s panel valuer a call and get an indication of the property value.

The bank valuer might agree or disagree with the Purchase Price.

Regardless which a market value indication will be given to the bank’s officer.

If the Property Market Value is the same as the Property Purchase Price, the bank officer will recommend the application up to the maximum bank margin.

If the maximum bank margin is 90%, a recommendation of RM500,000 x 90% = RM450,000 will be submitted for approval.

What happens when the Property Market Value is lower?

Let said; the market value is RM480,000.

Then the bank officer will recommend RM480,000 x 90% = RM432,000 as the approval amount.

The bank will honor Market Value or Property Purchase Price whichever is lower.

Tip:

If the Property price is way higher than the market value, you might want to consider dropping the purchase.

The seller is trying to sell at a higher price and maximize his/her profit.

WHAT DO YOU LEARN SO FAR?

1. Market value is essential to determine your loan amount.

2. A lower loan amount means you have to put down a more down payment.

3. Your purchase price should not be lower than your market value.

4. When market value is lower than the purchase price, it means the property is overpriced.

5. When the market value is higher than the purchase price, it means the property is cheap. As a purchaser, this is what you want.

HOW TO CHECK THE MARKET VALUE OF PROPERTY? (FOR FREE)

Now you know the property market price is important, so how to check the property market value?

There are two ways to check it.

1. Ask a banker to do it.

You can use the conventional way, by asking your bankers to check it.

Just forward the property details, and they will call up their panel bank valuer and get a verbal indication.

However, some bankers might be reluctant to check if you haven’t booked a property as they want a genuine client.

Many customers like to make a fool of the bankers by asking them to check the value without engaging with them. So, I can’t blame the bankers for being like this.

If you’re a genuine case, I think most bankers will help you to check the property value.

So, if you still in the early stage of surveying for a house. You want to get an estimation of the property. I have another way for you.

2. You can check it online by going to https://www.brickz.my/

We have found that https://www.brickz.my/ provide actual property transaction price.

So, with the actual property transaction price, you can estimate the property value for the property.

Let us walk you the steps on how to check the property value online.

STEP 1: GO TO THE MAIN PAGE

https://www.brickz.my/

You want to go to Brickz website.

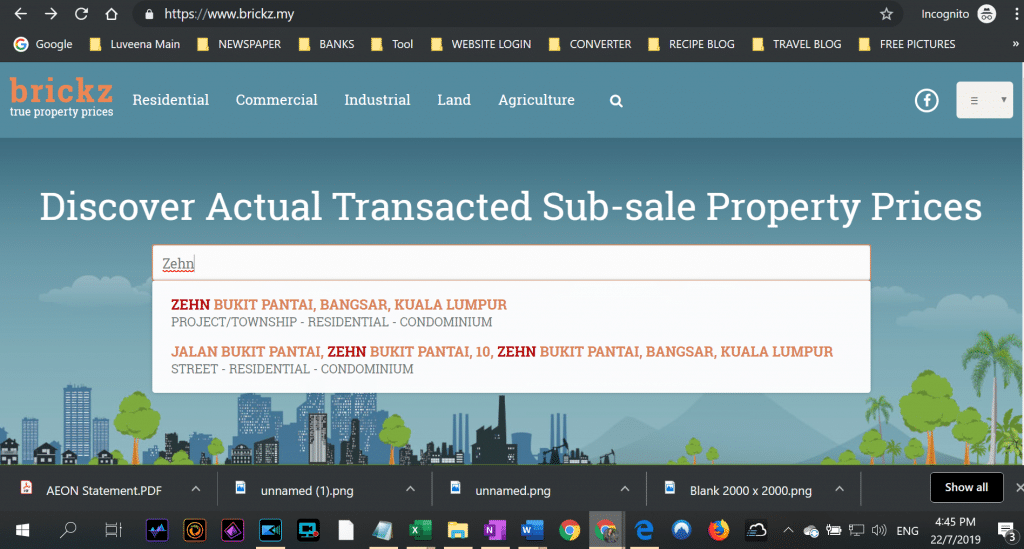

STEP 2: KEY IN THE PROPERTY DETAILS, LIKE CONDO NAME OR THE STREET NAME

Key in the condominium or apartment name or even street name.

It will come out with a suggestion and click the right one.

Then, it will bring you to another page.

Bear in mind that some of the projects that are too new might not in the listing.

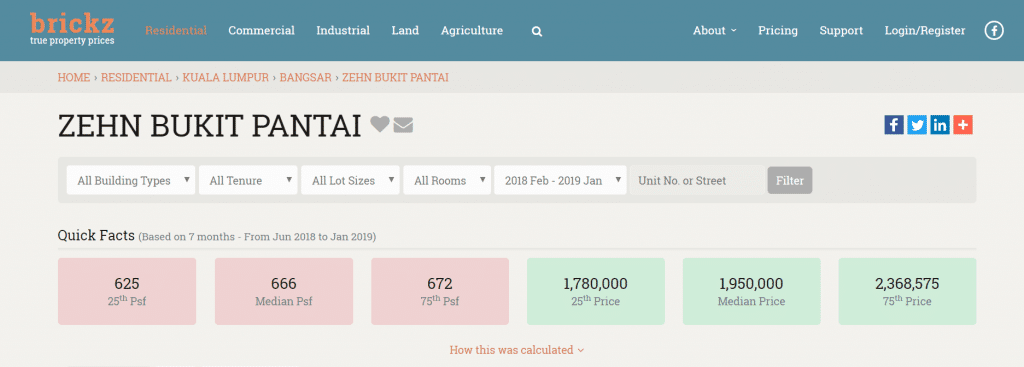

STEP 3: IT WILL SHOWS YOU THE RESULT

It will show you the result. There is two part of this.

The first part is it will show the price per square foot of the property.

There are lowest, medium, and higher price per square foot.

For example, as per the picture below 625 psf is the lowest price, 666 psf is the average price, and 672 psf is the highest price.

Among the three, you want to take the average price as your guide. That will be more ideal. You don’t want to quote the property value to high or undervalued the property.

In this case, you want to take 666 psf as the average price.

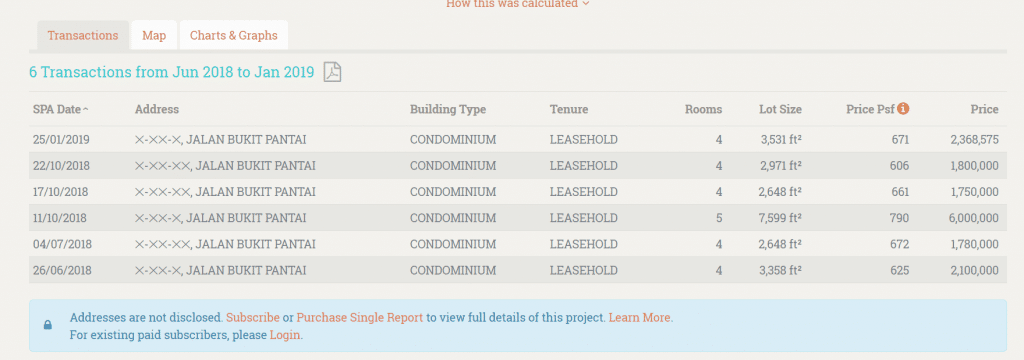

The second part is the specific unit transaction in the condominium or surrounding area.

You will see the SPA date, address, building type, tenure, number of rooms, size of the property, the price per square foot, and the amount transacted.

STEP 4: HOW TO CALCULATE THE PROPERTY VALUE?

Now, you have the average price for the property. What you need next is the property built-up ( for condo/apartment) or land size ( for terrace house) of the property.

For example,

666 psf as the average price.

If the property built up is 1500 sqft, so you want to multiply with the average price per square foot.

666 psf x 1500 sqft = RM999,000 as the estimate property market value.

NOW YOU HAVE THE PROPERTY VALUE, HOW TO USE IT?

If you have the property value, you can make a lot of financial prediction and negotiate for a better price.

We’re going to give you a few advantages and teach you how to use it.

1. While researching or surveying for the property to buy. You can eliminate property that too expensive or over the property market value.

2. When negotiating with Property Agent or Seller, you know what the price to negotiate. You can turn down an offer that is too expensive or too high. Or negotiate with better price.

3. You can calculate your loan amount and estimate how much the installment per month. Once you have the installment, you can determine your affordability of buying the house.

4. You can estimate your cost. The cost that you need such as Sale and Purchase Agreement lawyer fee, Loan Agreement lawyer fee, Property and Loan Stamp Duty, Valuation cost, and downpayment.

Important Note:

The technique of using brickz website to calculate the property market value is only an alternative way prior to getting the actual valuation from the bank or from the valuer company.

Used this technique for estimation calculation only.

Some property value might not be applicable this way as there are other factors to consider like the property renovation, house extension, location, build up size, land size, additional land size, etc.

If you need an actual market value you should reach out to a property valuation firm to prepare a valuation report for your house.

So, we hope this article is beneficial to you – How To Check The Market Value Of Property? ( FOR FREE)

If you think this article is useful, please like and share the article online with your friend and family.

Don’t forget to follow us on Facebook and Youtube.

I’ll see you in our next article.

Melissa

Online Mortgage Consultant

0126946746 ( David)

www.malaysiahousingloan.com

Request A Free Quotation From Us Today

Quotation For

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

Dear Sir,

I would like to sell my house in Rimbun Vista, S2 Heights, Seremban 2, Negeri Sembilan and would like to know current market value for the house. Details are below:

Type: 2 storey terrace (gated and guarded)

Size : 75 x 24

Fully renovated and tiptop condition.

sorry, we don’t provide random market value checking. But you can try to ask a banker to check or go to https://www.brickz.my/ to check the property value. thanks

Please take note.

if landed property, please make sure got 2 elements in your estimation of value. Land and built-up area.

Do not just multiply the land value by the psf. It is very misleading as the built-up area could be playing a vital in estimate the value. You dont know the sale with a bigger or smaller built up area. The difference could up to few hundred thousand.

This may be due to the easy access to the psf since the display of the field(psf) is already there. You cannot expect those property websites auto-detect programmatically the landed or stratified properties in their websites. So, a lot of people just apply it, very misleading.

my 2 cents.

Thank you for your input.

In actuality, determining a property market value is not as simple as a calculation based on the property land size or build-up size. There are indeed more factors to consider.

The above calculation is merely for preliminary estimation only.

A borrower should always check their property market value with a bank or, even better, reach out to a valuation company.

Valuation companies will give the most accurate market value but with a price. You need to pay them for their service or try to get a quote from them.

That is why many just reach out to a banker. Yet sometimes, different bankers will provide various market values. This is because every bank has its panel valuation firms.

Different valuation firms will also have their own opinion on a specific property value. It’s hard to be the same sometimes. Most of the time, you will get a range of market value.

Anyway, thank you for your suggestion. We do appreciate it.

????MElissa

Online Mortgage Consultant

Whatsapp Us: https://wa.me/+60126946746 (talk to Mr. David)

#malaysia

#MalaysiaHousingLoan

#homeloan

#homeloanspecialist

#financialconsultant