Cost of Refinancing Malaysia 2024

Like many other house owners, Cindy was confused with all the Cost of Refinancing in Malaysia.

Well, who doesn’t when there is a long list of the Cost of Refinancing?

Lucky for you today, we’re going to share the Cost of Refinancing, and hopefully, you can use this as a guide when refinancing your house.

1. Penalty Fees ( Depend on the penalty period)

Penalty Fees is a penalty imposed by the existing bank when you closed your home loan account with them.

The reason for a closing account can be because of refinancing to other banks, selling the property, or even fully settle the home loan using cash or EPF withdrawal.

Typically, the bank will impose a three to five years lock-in period to the home loan. And if the account closed within the stipulated period, the bank will charge a penalty fee of 2-3% from the original home loan amount.

Therefore, it is essential to check the penalty period status before proceeding for refinancing.

In the event, after checking and satisfy with knowingly the penalty fees as such, you should consider this as your refinancing cost as well.

2. Loan Agreement Professional Legal Fee, Stamp Duty Fee, And Disbursement Fee (Compulsory)

A borrower applying for a home loan with any bank will enter an agreement call Loan Agreement.

The preparation of the Loan Agreement will include Bank as the Lender and You as The Borrower.

A Bank Lawyer is required to prepare such documents, and the preparing of such documents will require specific fees.

So, the fees are Loan Agreement Professional Legal Fee, Stamp Duty Fee, and Disbursement Fee. All these three fees will be in one quotation where we called Loan Agreement Quotation.

In the Loan Agreement Quotation, you will get all these three fees that will be list down by the bank lawyer. You can always ask for a loan quotation from the loan lawyer before signing the loan agreement. You have every right to do so.

And if you need a Loan Agreement Quotation, feel free to request from us here.

https://malaysiahousingloan.net/legal-fees-calculator/

Generally, all these fees are in the range of 2-3% of your approved loan amount. But, if your loan amount is less than RM200,000, it might be higher than 3%.

For instance,

If the loan amount is RM500,000. Here how you can estimate the Loan Agreement Fees.

RM500,000 x 2% = RM10,000

RM500,000 x 3% = RM15,000

So, the Loan Agreement Fees should be in the range of RM10,000 to RM15,000.

Here is the sample of the Loan Agreement Quotation.

Typically, the Loan Agreement Quotation will be based on this information to determine the total fees.

a. Total Loan amount.

b. The Property is under Master Title or Individual Title/Strata Title.

c. The property is under which states. For Example, Selangor and Johor will have different registration fees.

d. The total borrower in the loan agreement.

Once the bank lawyer receives such information, they will be able to issue a Loan Agreement Quotation.

3. Valuation Fee (Compulsory)

The valuation fee is a fee charged by a valuer company for the works they carry to do. In this case, the bank has been asking them to complete a valuation report.

A Valuer will arrange an appointment with the borrower and site visit the property.

They will take a couple of photos, measurements, and some of the Sale and Purchase Agreement Layout page copy. If you did a renovation to the house, you might need to support it with the authority approval and architect layout.

Once they get all the information, they will start to draft a valuation report and complete it.

The valuation report basically will mention the actual market value of the property and some justification on the property to support such value.

After that, a Register and Professional Appraisal will sign on the valuation report and submit to the bank for further review.

Bear in mind, sometimes the value in the valuation report might not match the initial Market Value. Frequently, the issue happens when the banker mistakenly interprets the information given verbally by the client. Or the client himself given the wrong information to the banker.

When this happens, the bank will re-evaluate the case, and new loan approval will be approved. Most of the time, the loan amount will be slash lower. Hence, the cash-out will be lesser.

Generally, the valuation fee is about 0.50% from the original loan amount. If you need an exact amount of the valuation fee, you can ask the cost from a banker.

4. Bank Processing Fee ( Depend on the bank )

A bank processing fee is a fee charged by a bank for processing your application. Usually, the processing fee will be charged once you accepted the bank offer.

Some banks might use a different term like an account set up or opening account fees, but it still comes to the same, which a cost that charge by the bank and a cost you need to pay.

Typically, this fee is not much; it’s in the range of RM50-RM200 at one time charged.

Mosts bank doesn’t charge you, but some still do.

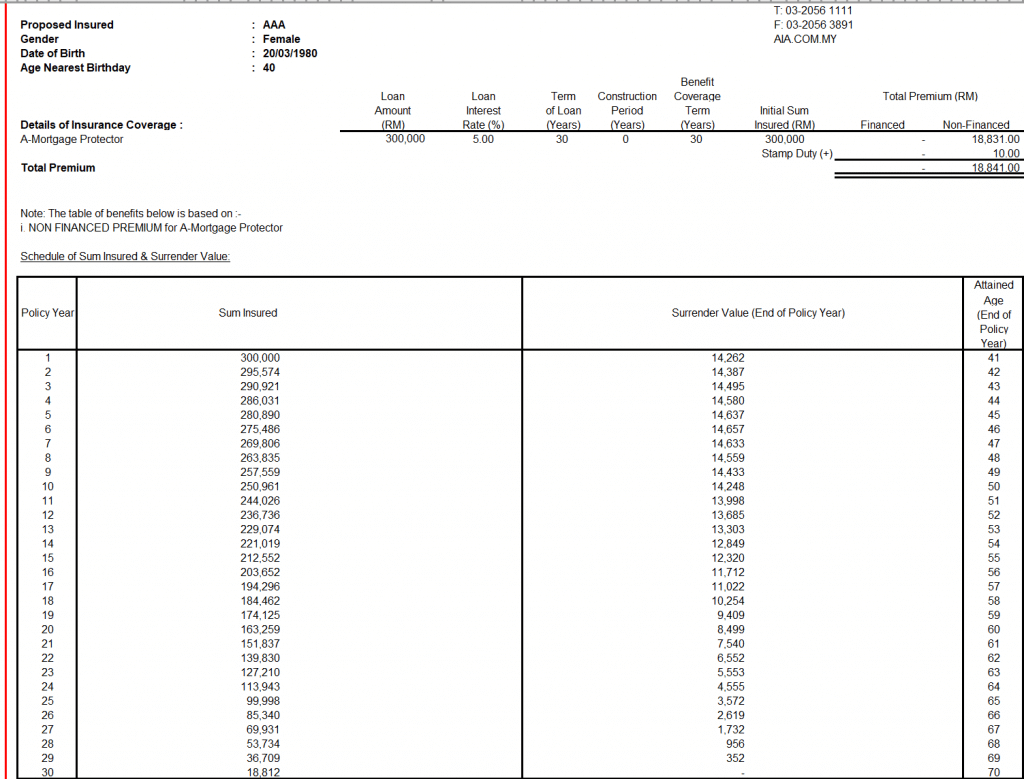

5. Mortgage Reducing Term Assurance ( MRTA ) ( Optional)

Mortgage Reducing Term Assurance ( MRTA ) is insurance that covers the borrower in the event of death or total permanent disability (TPD).

When unforeseen circumstances happen, per se the death or TPD; under Mortgage Reducing Term Assurance ( MRTA), the insurance company will cover the outstanding loan.

Depending on how much you buy the Mortgage Reducing Term Assurance ( MRTA ), they have a diagram you can refer to. The coverage solely follows the diagram.

On the diagram, they have policy year and sum insured amount on the left, surrender Value, and End of policy year on the right.

You always have the option to choose your coverage amount and coverage years; it’s not necessary to get full coverage. Discuss with your banker or insurance agent.

The cost of Mortgage Reducing Term Assurance ( MRTA ) is typically a one-off thing. You can choose to pay by cash or finance with the loan.

If you’re interested in getting a Mortgage Reducing Term Assurance ( MRTA ) proposal, click here to request it.

https://malaysiahousingloan.com/contact-us/

The bank encouraged everyone to buy Mortgage Reducing Term Assurance ( MRTA ). Typically people buy it because of the attractive Home Loan interest rates offer.

If you buy a Mortgage Reducing Term Assurance ( MRTA ), the bank will offer lower Home Loan interest rates in comparison to someone who doesn’t.

The fact is most banks have a flexible policy on this. It is not compulsory and only optional.

Mortgage Reducing Term Assurance ( MRTA ) cost depends on the insured age, coverage amount, home loan interest rate, gender, and years of coverage.

Also, paying methods like paying with cash or finance in the loan will increase the Mortgage Reducing Term Assurance ( MRTA ) insurance premium. Usually, when you finance MRTA with the home loan, the premium tends to be pricier.

Okay, that is the end of Cost of Refinancing Malaysia article.

If you enjoy this article, feel free to share this article with your friends and family. And I see you in the next one.

#Malaysiahousingloan

Melissa Lee

Online Mortgage Consultant

012-6946746 (David)

Request A Free Quotation From Us Today

Quotation For

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

Leave A Comment