Budget 2020 Malaysia Property & Real Estate

Our Finance Minister announced Budget 2020 Malaysia today, and it’s quite a comprehensive Budget 2020 that I think will make lots of us very happy.

It is a reasonable budget for 2020. It covers a few critical subjects like the move to abolish tolls by stages, Bantuan Sara Hidup ( BSH ) to a new group, Petrol Subsidy from low to middle income, and the education sector.

There also an allocation fund to the Ministry of Health to build more hospitals and maintain the existing one.

Among all, my favorite is the incentive given to women who have not worked for more than a year. Not only they will receive a monthly RM500 incentive when they work, but their employers will also receive RM300 incentive monthly by hiring them. Wow to that!

Okay, enough said about other sectors. So, how about Budget 2020 for property or real estate highlights?

Let me be honest; it is not exciting like last year.

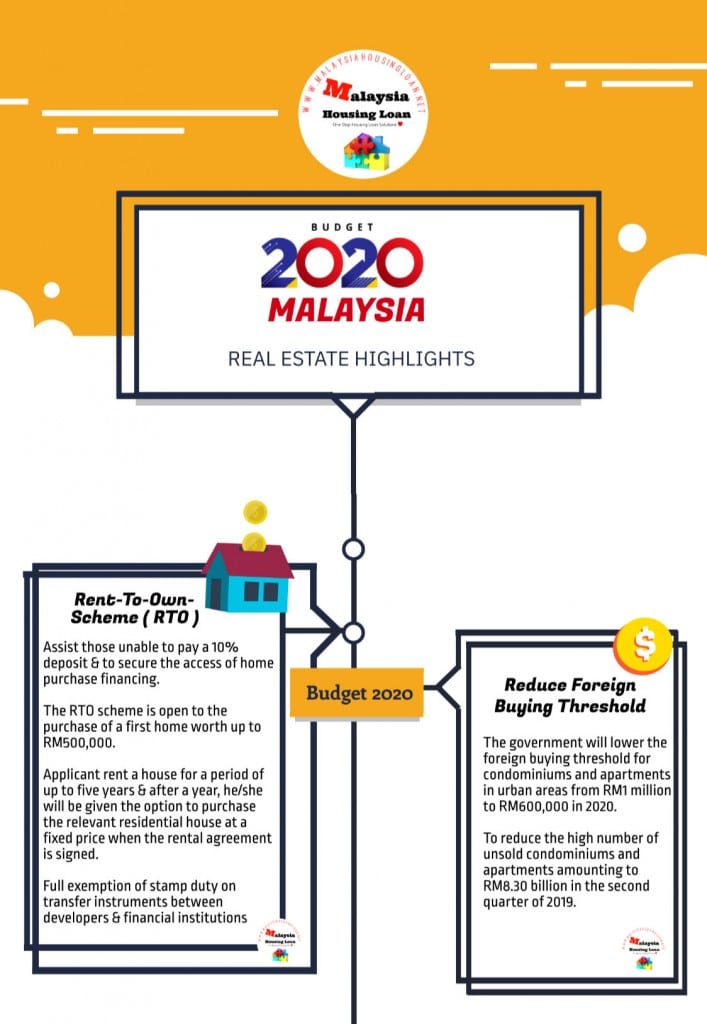

Rent-To-Own Scheme ( RTO )

The first thing that YB Lim Guan Eng cover is Rent-To-Own Scheme (RTO).

This Rent-To-Own Scheme (RTO) suppose to assist those who are unable to come up with a 10% deposit but want to have their own house.

So, the government will be joining hands with financial institutions to introduce a Rent-To-Own Scheme (RTO).

Through the Rent-To-Own Scheme (RTO), RM10 billion financing will be provided by financial institutions with the government’s support through a guarantee provision of 30% or RM3 billion.

Under this Rent-To-Own Scheme, the applicant will rent a house for a period of up to five years.

After a year, he/she will be given the option to purchase the relevant residential house at a fixed price when the rental agreement is signed.

The scheme is open to first-time house buyers and houses worth up to RM500,000.

The government will provide a full exemption for stamp duty for instrument of transfer and loan agreement to the respective buyers.

Foreigner Purchasing Threshold Reduce To RM600,000

By 2020, the government will lower the foreign buying threshold for condominiums and apartments in urban areas from RM1million to RM600,000.

The reason is to reduce the number of overhang or unsold units of condominiums and apartments amounting to RM8.30 billion in the second quarter of 2019.

Home Ownership Campaign ( HOC )

To date, approximately 21,000 homes worth RM13.44 billion successfully sold under this campaign, which exceeded the initial sales target of RM3 billion.

Benefit Under Home Ownership Campaign ( HOC

- 10% Discount offered by Developers ( of the approved property selling price)

- Stamp duty exemption on Instruments of Transfer ( for the first RM1million)

- Stamp Duty Exemption on Instruments of Loan Agreements. ( Up to RM2.50 million )

Home Ownership Campaign ( HOC ) 2019 Eligibility

- Only for residential properties.

- Property priced RM300,001 to RM2.50 million. ( before 10% discount)

- Sale from a developer to a purchaser or co-purchasers, all of whom are Malaysian citizens.

- Sale and Purchase ( SPA ) executed between 1 January 2019 to 31 December 2019.

- A minimum of 10% discount applies to all units that not subjected to government price control.

- Eligible properties in Peninsular Malaysia registered with REDHA Malaysia.

- Eligible properties in Sabah & Sarawak registered with SHAREDA and SHEDA, respectively.

Illustration of Saving from the purchase of a property priced at RM500,000 under Home Ownership Campaign ( HOC )

- Saving from 10% discount offered by a developer based on the purchase of property priced RM500,000 is RM50,000

- Savings from Stamp Duty exemption on instruments of transfer ( SPA price after 10% off is RM450,000 ) is RM8,000

- Savings from stamp duty exemption on instruments of the loan agreement ( 90% margin of Financing – RM405,000) is RM2025.

- Total Savings: RM60,025

Bank Negara Affordable Housing Fund

As of September 2019, a total of 2,840 applications amounting to RM472.7 million were received.

The approval rate is 77.9%, with 982 total applications worth RM156.2 million being approved.

The key features under BNM’s Fund for affordable homes are as follows.

Features:

- Property Financing Up to RM300,000

- The margin of financing may include down payment support and mortgage term assurance/takaful contribution.

- Applicable for residential properties in the primary market only.

- The financing rate is up to 3.50% p.a.

- The financing tenure is up to 40 years or up to age 70, whichever is shorter.

- Moratorium on Sale of the property is up to 5 years.

- Potential borrowers are required to attend Agensi Kaunseling dan Pengurusan Kredit ( AKPK ) mandatory online training of financial education module.

- The training is to assist potential borrowers in understanding their financial commitments before purchasing a home.

- The module can be accessed from AKPK’s Rumahku portal at learnakpk.org.my from 3 November 2018.

Eligibility:

- Must be a Malaysian Citizen.

- A maximum monthly household income of RM4360 is required.

- Salaried workers or self-employed.

- Single or joint borrowers.

- There is no record of impaired financing for the past 12 months.

Contact Centre of the Participating Financial Institutions:

AmBank (M) Berhad (AmBank) 03-2178 8888

Bank Simpanan Nasional (BSN) 1-300 88 1900

CIMB Bank Berhad (CIMB) 03-6204 7788

Malayan Banking Berhad (Maybank) 1-300 88 6688

RHB Bank Berhad (RHB) 03-9206 8118 (West Malaysia); 082-276118 (East Malaysia)

The public may also contact BNMTELELINK at 1-300-88-5465 (LINK)

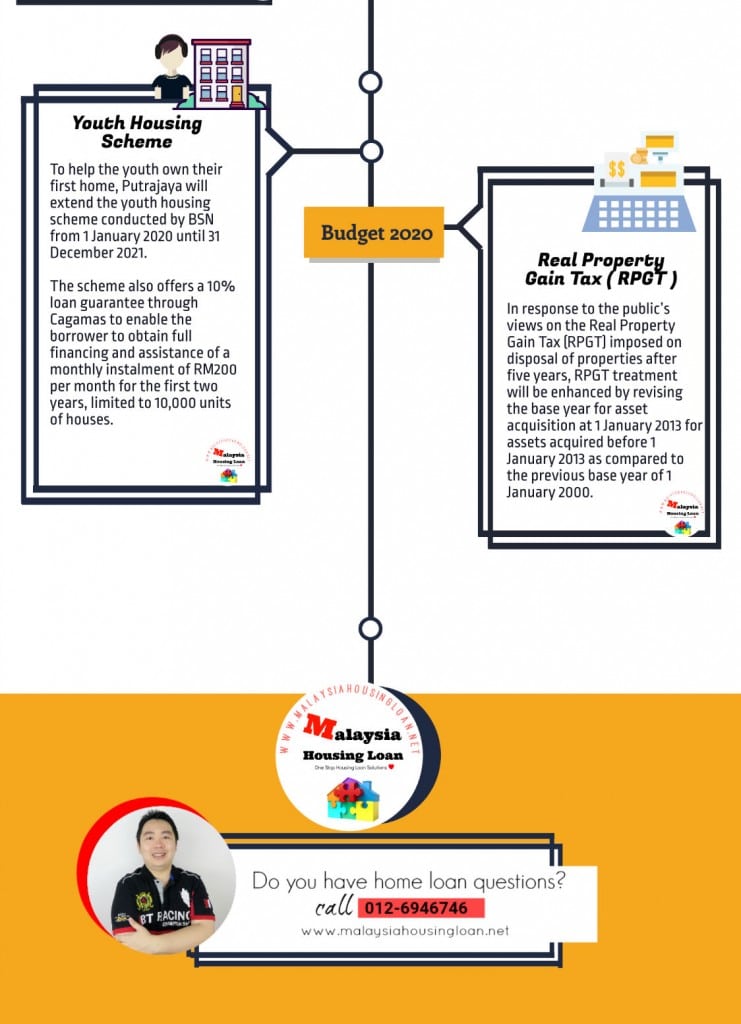

Youth Housing Scheme ( YHS )

The purpose of the Youth Housing Scheme ( YHS ) is to help the youth own their first home.

Putrajaya will extend the youth housing scheme conducted by BSN from 1 January 2020 until 31 December 2021.

Under the scheme, it also offers a 10% loan guarantee through Cagamas to enable the borrower obtaining full financing and assistance.

A monthly installment of RM200 per month will be given for the first two years, limited to 10,000 units of houses.

Key Features

- Provide loan amount of 100% of the purchase price, RM500,000

- Provide 5% of the purchase price to finance insurance (MRTT/MRTA)

- 50% of stamp duty exemption on loan and transfer agreements

- Monthly installments of RM200 per month for two years

Eligible Buyers & Financing Requirement

- Married youth aged between 25 to 40 years old

- Monthly Household Income (Two persons) must not exceed RM10,000 per month

- Maximum financing tenure is 35 years, provided borrower’s age does not exceed 65 years at the end of the mandate.

Real Property Gain Tax ( RPGT )

In response to the public’s views on the Real Property Gain Tax (RPGT), the government will impose on the disposal of properties after five years as follows.

Real Property Gain Tax ( RPGT ) treatment will be enhanced by revising the base year for asset acquisition on 1st January 2013 for assets acquired before 1st January 2013.

Previously, the based year was 1st January 2000.

As for the stamp duty calculation and stamp duty exemption for the year 2020, it will be the same as stamp duty Malaysia 2019.

Let us highlight the stamp duty exemption that will be implemented in 2020.

What are the Criteria to get Stamp Duty Exemption?

There are a few Stamp Duty Exemption for the year 2019. We’re going to list out a few stamp duty exemptions.

Stamp Duty Exemption 2019 For Subsale or Under Construction Property

- Must be a first-time house buyer.

- You never own or inherited a house.

- A completed house with a residential land title. Subsale house.

- You are buying a completed house from a Property Agent, Seller, and developer.

- Or you are buying an under-construction house from a developer.

- The house must not fall under a small office home office (SOHO), small office flexible office (SOFO), small office virtual office (SOVO) dan service apartment.

- Property Price/ Value must be less than RM500,000

- The maximum exemption is up to the first RM300,000 stamp duty amount.

Stamp Duty Exemption Calculation

The First Example,

- If the property Purchase Price or Property value is RM300,000, the property stamp duty will be as follows.

For the first RM100,000, 1% : RM100,000 x 1% = RM1000

From RM100,001 to RM200,000, 2% = RM200,000 x 2% = RM4,000

Total Stamp duty is RM5000.

Total Stamp Duty exemption for a first-time homebuyer is RM5000.

The Second Example,

- If the property Purchase Price or Property value is RM400,000, the property stamp duty will be as follows.

For the first RM100,000, 1% : RM100,000 x 1% = RM1000

From RM100,001 to RM300,000, 2% = RM300,000 x 2% = RM6,000

Total Stamp Duty is RM7,000

Total Stamp Duty exemption for a first-time homebuyer is maximum RM5000.

So, you shall pay the difference RM7000-RM5000= RM2000.

Stamp Duty Exemption For Loan Agreement

Besides the above exemption, if you are applying for a home loan for the above property, the loan agreement stamp duty will be exempted too.

- The loan agreement Stamp Duty is 0.50% from the loan amount.

- If the loan amount is RM300,000, the stamp duty for the loan agreement is RM300,000 x 0.50% = RM1500

- You don’t need a loan stamp duty calculator to calculate this. Just use your physical calculator.

- The exemption applies to a maximum loan amount of RM300,000.

- If the loan amount is RM400,000, the loan agreement stamp duty is RM400,000 x 0.50% = RM2000.

- The maximum stamp duty exemption for the loan agreement is RM1500.

- So, you shall pay the difference RM2000-1500 = RM500.

So, that’s about Budget 2020 Malaysia, and we hope you will enjoy the article. As usual, if you do, don’t forget to SHARE and LIKE our social page.

#malaysiahousingloan

Melissa Lee

Online Mortage Consultant

012-6946746 ( David )

www. malaysiahousingloan.net

Leave A Comment