Perfection of Transfer (POT) & Perfection of Charge ( POC )

Today, we received a question about the Perfection of Transfer (POT) & Perfection of Charge ( POC ) from a client.

The question is quite general, but I believe some of us might benefit from this.

So, this is the story.

Five years ago, I bought a condominium from a developer. The property price is RM1.10 million.

Today, the property strata title is issued, and I received a letter from the developer asking me to complete the Perfection of Transfer (POT) & Perfection of Charge ( POC ).

So, my question is, how much will I need to pay for the Property Stamp Duty? Will I need to pay 3% or 4% rates?

Thanks.

Understand Perfection of Transfer (POT) & Perfection of Charge ( POC )

Okay, let me explain a little bit about the Perfection of Transfer (POT) & Perfection of Charge ( POC ) for people who do not know about this.

The perfection of Transfer (POT) is a process to change the name on the title from developer name to the owner name, which is YOU. And the perfection of Charge (POC) is a process to charge the property title to the bank.

In the event, the property is without a bank loan, then you’re not required to do a perfection of charge ( POC ).

Most of the time, when a person buying an under-construction house from a developer, the property title is still under a master title.

Generally, the Master title refers to a bigger piece of land, which including building lots or parcel lots that haven’t divided into individual building lot or parcel lot.

If you want to know more about the difference between master title, individual title, and strata title, I have an article about this.

Eventually, a master title will be sub-divided to a smaller plot, which we call strata title or individual title. When this comes to the picture, that will be when you need to do a Perfection of Transfer (POT) & Perfection of Charge ( POC ).

At the same time, when you buy a complete master title property from a Seller, you’ll need to do a Perfection of Transfer (POT) & Perfection of Charge ( POC ) when the strata title or individual title issued a few years later too.

The only difference between when you buy from a developer and a seller is, when you buy from a developer, you’re not required to pay the stamp duty upfront.

You can wait to pay the Stamp Duty when you’re required to complete the Perfection of Transfer (POT) & Perfection of Charge ( POC ).

While buying a complete master title property from a Seller, you have to pay the stamp duty upfront during the signing of the Sale and Purchase Agreement ( SPA ).

And when the time comes for you to complete the Perfection of Transfer (POT) & Perfection of Charge ( POC ), you need to pay the legal fees without the Stamp duty.

Okay, I’m going to tell you the most critical point here. Read it carefully. Don’t let anyone fool you.

Regardless, buying from a developer, Seller, auction, or agent, you’re only required to pay the stamp duty ONE TIME.

If you paid the Stamp Duty during the signing of the Sale and Purchase Agreement (SPA), then when the title issued, you don’t need to pay again.

The reason we are highlighting this is there are cases where a reader came to us and saying the lawyer demand them to pay the Stamp Duty again. And, it’s NOT RIGHT.

I hope you understand so far.

Okay, come back to the question.

From the question, I know that the client is confused with the new Property Stamp Duty rates.

Let me explain.

Effective 1st July 2019, the stamp duty rates are as below.

For the first RM100,000 is 1%

RM100,0001 to RM500,000 is 2%

RM500,001 to RM1,000,000 is 3%

RM1,000,001 onwards is 4%

The old scale looks like this.

For the first RM100,000 is 1%

RM100,0001 to RM500,000 is 2%

RM500,001 And Above is 3%

The client question is whether the new scale or old scale will be applied to him?

What do you think? I give you five seconds to think.

.

.

If your answer is the new scale, then, you’re RIGHT!?

You have to follow the latest year ruling of stamp duty rates.

Let’s do some calculations.

How much stamp duty he needs to pay for the old or new scale?

Purchase Price: RM1.10 mil

New Scale!!

Effective 1st July 2019, the stamp duty rates are as below.

For the first RM100,000 is 1% = RM1,000

RM100,0001 to RM500,000 is 2% = RM8,000

RM500,001 to RM1,000,000 is 3% = RM15,000

RM1,000,001 onwards is 4% = RM4,000

Total = RM28,000

The old scale looks like this.

For the first RM100,000 is 1% = RM1,000

RM100,0001 to RM500,000 is 2% = RM8,000

RM500,001 And Above is 3% = RM18,000

Total = RM27,000

Difference = RM28,000 – RM27,000 = RM1,000

Yes, RM1,000 different from the old to the new scale.

The Perfection of Transfer & Perfection Of Charge Legal Fees

You can always hire another law firm to handle the Perfection of Transfer (POT) & Perfection of Charge ( POC ). But it is going to cost you more on the lawyer fees.

The existing lawyer is allowed to charge only 25% of the full-scale fees, subject to a minimum fee of RM200. For example, if the Lawyer fee is RM5000, 25% will be RM1250. Don’t let them charge you more than this.

While for whatever reason, you need to hire an outside lawyer, they will be charging you from 25% to 50% of the full-scale fees, subject to a minimum fee of RM200.

Of course, it always best to go back to the existing law firm, but sometimes a client value quality over quantity. So, they might want to look for a better option.

If you need a Perfection of Transfer & Perfection Of Charge legal fees quotation, feel free to fill up your detail below or click the link here.

https://malaysiahousingloan.com/legal-fees-calculator/

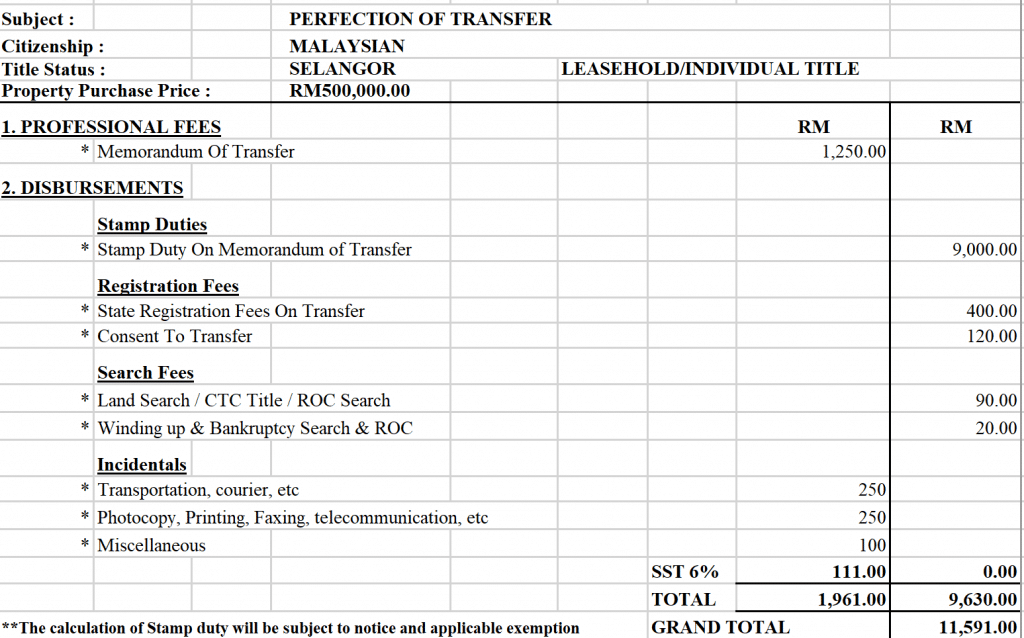

Calculation Perfection of Transfer (POT)

A perfection of transfer quotation will include a few things.

- Memorandum of Transfer Professional Lawyer Fees

- Stamp Duty

- Disbursement fees such as registration fees, consent to transfer, land search, winding up and bankruptcy search, transportation, photocopies, etc.

Usually, a significant amount comes from Stamp Duty. If you paid the Stamp duty during signing Sale & Purchase Agreement ( SPA ), you could ignore this amount.

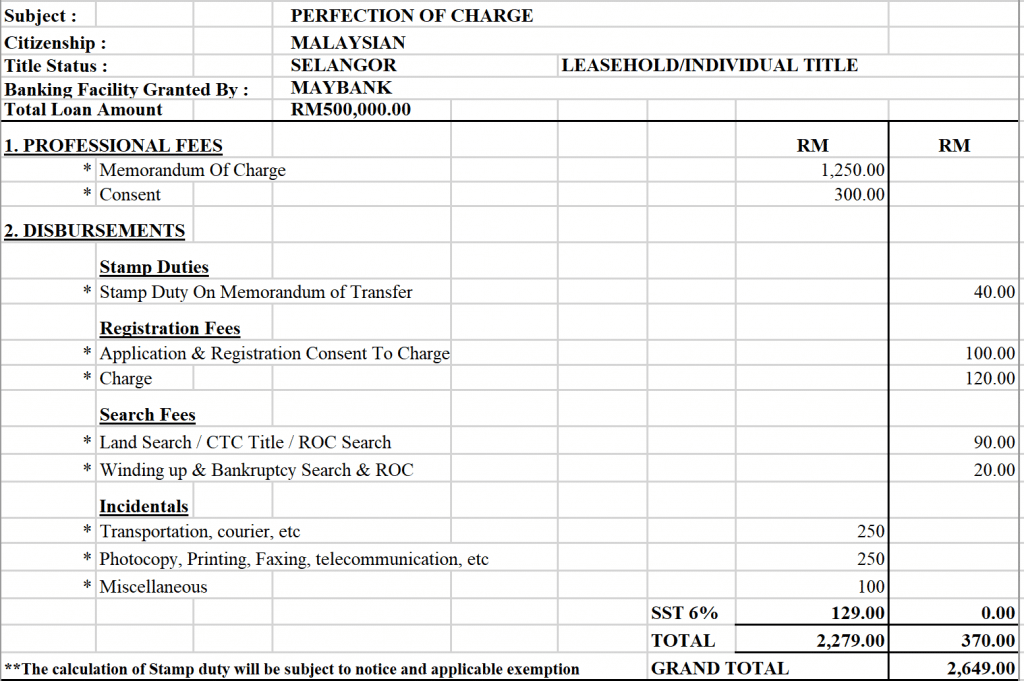

Calculation Perfection of Charge (POC)

A perfection of charge quotation will include a few things, almost the same as the Perfection of Transfer, except the stamp duty.

In the case of perfection of charge, the stamp duty is only RM40 to stamp the relevant documents.

- Memorandum of Charge Professional Lawyer Fees

- Stamp Duty

- Disbursement fees such as registration fees, consent to transfer, land search, winding up and bankruptcy search, transportation, photocopies, etc.

Okay, so we come to the end of the article.

Feel free to share this article with someone who is going to benefit from it.

If you have further questions about the perfection of transfer and perfection of charge, you can reach us at 012-6946746 or request a quotation now.

I see you in the next one!

#malaysiahousingloan

Melissa Lee

Online Mortgage Consultant

012-6946746 ( David )

www. malaysiahousingloan.com

Request A Free Quotation From Us Today

Quotation For

-

SALE AND PURCHASE AGREEMENT MALAYSIA

-

LOAN AGREEMENT MALAYSIA

-

TRANSFER OF PROPERTY MALAYSIA

-

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA

-

AUCTION PROPERTY MALAYSIA

-

SELLER QUOTATION FOR SUB SALE PROPERTY MALAYSIA

I am referring to Melissa Lee’s article where she mentioned that whether the new scale or old scale of POT stamp duty will be applied to SPA signed in for example year 2015 in my case. The developer lawyer is quoting me using the current rate which is 4% for tier 1mil and above. So I am confused after reading this article. Please enlighten.

Hi Boon, as we know the POT stamp duty should be following the 2015 stamp duty scale fees not the latest year. You can check this information with the stamp office by calling LHDN. Or you can ask your lawyer to show the stamp duty notice before paying for the stamp duty.

Thanks.

Melissa

Stamp Duty (Remission) Order 2014 provides for the remission of 50% from the stamp duty

chargeable on any loan agreement to finance the purchase of only one unit of residential

property costing not more than RM500,000, subject to the stipulated conditions. and this order came into effect on 1 Jan 2015, and are applicable where the Sale and

Purchase Agreement is executed on or after 1 Jan 2015, but not later than 31 Dec 2016.

but i was told by both lawyer and developer that this rule is only applicable for property between RM300,000 to RM 500,000, any SPA price below RM 300,000 will not be given 50%? Is that true?

Answer :

Thanks for your question.

Yes, you are correct. Under Stamp Duty (Remission) Order 2014, it provides two remissions of stamp duty.

Remission of 50% from the stamp duty chargeable on any loan agreement to finance the purchase of only one unit of residential property costing not more than RM500,000, subject to the stipulated conditions.

Remission of 50% from the stamp duty chargeable on any instrument of transfer for the purchase of only one unit of residential property costing not more than RM500,000, subject to the stipulated conditions.

In my personal view, I think the lawyer firm is confused between the 2015-2016 year remission order with the year 2020.

As long as your Sale and Purchase agreement and loan agreement was stamped between 1st January 2015 but not later than 31st Dec 2016. Your property will be followed the Stamp Duty (Remission) Order 2014.

You can attach the stamp duty remission order 2014 to your lawyer.

Follow this link to download.

https://bit.ly/34d2Dq7

I hope this helps.

Thanks.

LIKE, SHARE & FOLLOW US!

Melissa Lee

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746 (talk to Mr. David)

#malaysia

#malaysiahousingloan

#homeloan

#homeloanspecialist

#financialconsultant

Hi Melissa, how do I know or check if I’ve paid the stamp duty during the signing of Sales & Purchase agreement?

Thanks for your question.

For a start, you can check the SPA legal fees bill, and from the bill, there is a column stated Stamp duty for SPA or Memorandum of Transfer.

Usually, the stamp duty amount is the most expensive or the second most expensive figure; it is hard for you to miss on the bill. Unless if you have a stamp duty exemption, the amount might be lesser.

If you misplaced the SPA bill, then maybe you can go back to the SPA lawyer and check it.

Alternatively, you can go to LHDN to check the stamp duty status on your property.

If you bought the property from a developer during construction, you typically haven’t pay the stamp duty.

But, if you bought the property from an owner or agent, most probably you paid the stamp duty.

I hope this answer is useful to you.

LIKE, SHARE & FOLLOW US!

Melissa Lee

Online Mortgage Consultant

Call or Whatsapp Us: 012-6946746 (talk to Mr. David)

Hi Melissa, I bought an apartment in year 1998 directly from the developer. Recently, I received a letter from liquidator requesting me to assign my own lawyer for POT.

Question:

1. Stamp duty should be calculated from purchase price or market price? Some lawyer quote me from purchase price, some by market price!

2. “While for whatever reason, you need to hire an outside lawyer, they will be charging you from 25% to 50% of the full-scale fees”

How to the full-scale lawyer fees of POT? I am confused because some lawyer calculate base on property market value, some quote me way too cheap (around RM300 for a new lawyer).

Hi Pei san,

1. The stamp duty should be calculated from purchase price.

2. Please click the link and fill up some information to get a POT quote from us. We will send you one and explain to you what is the full-scale and what is after the discount.

https://bit.ly/2JkS7WB

Hi Melissa.

I bought my first serviced apartment back in 2015, directly from developer. In the SPA contract, it did mention “FREE stamp duty, legal fees and disbursement cost”. Then, when the POT came recently, it mentioned stamp duty, legal fees and disbursement costs need to be paid. My question is, have those been paid prior by the developer, hence the term “Free” mentioned in the SPA contract? And should the purchaser pay again, now?

Thanks.

Hi, thanks for the question.

Normally, the FREE stamp duty, legal fees and disbursement cost are covering cost during the early purchase, NOT included POT.

Most of the time, you need to pay the POT on your own.

You can read this article where I did explain a little about your situation.

https://malaysiahousingloan.com/free-stamp-duty-legal-fees-and-disbursement-fees/

Hope this will help you.

thanks!