In this home loan library, we talk about home loan interest rates, latest package about home loan, news about home financing and many more.

Everything You Need To Know About CCRIS Report ( Brief Version)

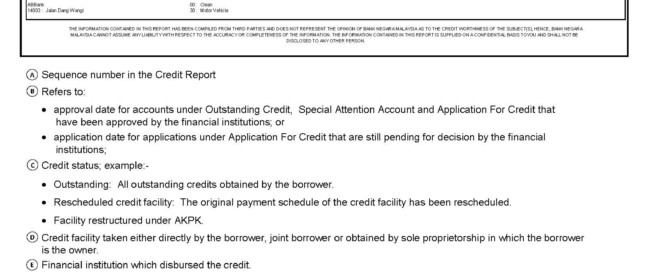

Hi, I guess this is worth sharing and if you're wondering what that information on the CCRIS Report mean, check out the simple, self-explanatory version of CCRIS report provided by Bank Negara Malaysia. It is important to review and understand your CCRIS Report before applying for any bank loan. I promise you, its will help [...]